10 Financial “Must-Knows” to Successfully Survive Your Divorce

Holly • June 29, 2015

by Sharon Numerow

1. Money will almost always become an issue in divorce

- Many people start out thinking and believing the promise that things will always be divided evenly and straightforward

- Money is sometimes used as a bargaining tool to resolve other issues

2. Gather everything you can about your family finances

- Make a list of your financial property

- Gather statements and documents on all property

- Frequently one partner is not “in-the-know” on the family finances which makes this task difficult

3. Understand that a 50/50 division of property is not always fair financially

- Take into account future value of property

- Comparable values of different types of property are not always equal due to tax implications

4. Consider the tax implications of all of your financial divorce decisions

- Consider the year in which you divorce, your change in marital status will affect your tax situation

- Consider the tax effect and true value of the assets you will retain

5. Make sure that you can afford to keep the house before you settle this matter

- Pre-qualify for a mortgage

- Upkeep costs can be expensive, both financially and emotionally

6. Understand the value of your investment and RRSP portfolios

- Understand tax liabilities and advantages of different investments

7. Ensure pensions are properly valued

- Defined Benefit Plans must always be valued by a specialist

8. Make sure that the payor of child and/or spousal support has life insurance to support these financial obligations

9. Seek FINANCIAL consultation during your divorce from a divorce financial expert not from a lawyer

10. Redo your will

In life, it’s often times important to look at the whole picture rather than just the one limited view. Getting the bigger picture allows you to see a situation in full and avoid making flawed decisions based on a skewed outlook. The same goes for planning for your financial future, where it’s important to ensure that all your financial assets are in place and working in unison to protect you and your family today and into the future. What is Holistic Planning? In the interest of that “bigger picture” and ensuring full financial protection for you and your loved ones, holistic planning should ideally encompass the following six areas: Financial Management – this includes your cash flow, savings, and debt repayment. Investment Planning – how you invest versus your risk tolerance and objectives. Insurance and Risk Management – how you protect you and your loved ones against unexpected losses due to death, disability, health issues, property damage and other risks (hint: it may involve insurance!). Tax Planning – considering current and future tax obligations, strategies to minimize and defer the negative impact of taxation as it relates to your financial plans, as well as means to strengthen your financial position to meet your goals. Retirement Planning – the lifestyle you wish to enjoy in retirement, how much it will cost and the journey to achieving this. Estate Planning and Legal Aspects – distributing your assets at your death efficiently, as well as naming your beneficiaries. Factoring legal aspects ensures any planning you do in your lifetime (or at death) doesn’t create any unforeseen issues. Being holistic involves assessing all six of these areas collectively (not in isolation), before planning or implementing any one of them. This ensures resources are allocated in a planned priority to achieve maximum efficiency and that one piece of planning doesn’t cause issues with another. The Benefits of Holistic Planning for your Financial Future Although there are indeed many benefits to planning your finances with a more holistic view in mind, here are just a few to consider: Confidence that you have robust and comprehensive planning in place – your planning is taken care of, so you can focus on enjoying your best life. Saving you time and money – ensuring the best use of your precious time and finances, having access to more competitively priced products and holistic financial services via one Advisor (a one stop shop!) Proactive conversations with your other professional Advisors – an Advisor providing holistic advice will be comfortable engaging with your other Advisors such as accountants and lawyers. Ensuring your children/grandchildren retain cherished assets – holistic advice can ensure the next generation(s) can continue to enjoy the family cottage or other cherished assets, without having to sell them at an unfavourable price and time. Less to the Canadian Revenue Agency (CRA) and more to your loved ones – the best planning will ensure more of your assets pass to those you want them to (and when). Ensure children/grandchildren have access to great advice – there’s no need for your children/grandchildren to look elsewhere for advice. Protecting you in your accumulation phase – you may be a disciplined saver and a savvy investor for your retirement, but it’s important to complement these great attributes with adequate protection from unexpected sickness, disability or even death that could derail your saving and investing; especially if you have people dependant on your ability to earn. Tax and investment benefits – the financial planning universe is vast and holistic planning will ensure you make the most of any and all the tax saving and investment opportunities available and suitable for you. So next time you are looking at your finances or planning for your financial future, be sure to make it holistic planning in order to get the most of your hard-earned dollars and ensure that you and your family have the necessary protection in place today and into the future. Author: The Link Between

When I ask divorced women what they would say to their former married selves about their finances is “get to know your money”. The most regrettable thing that most divorcing women tell me isn’t that they regret getting married, it’s that they never learned about their household finances. They simply let their spouse take control... Read more »

No matter where you are in your life, whether you are going through a divorce or not, a budget matters. Everything you do in finance, personal or business, comes down to a well planned budget. The word “budget” is like the B-word no one wants to use but it’s an inevitable part of being a... Read more »

Spousal RRSPs have traditionally been used as an income-splitting strategy in retirement. You can contribute to your spouse’s RRSP but claim the tax deduction yourself. Your total contributions (to your own and your spouse’s plans) are subject to your own RRSP contribution limits. In retirement, withdrawals are taxed in your spouse’s hands rather than yours,... Read more »

A parent’s number-one concern is the health and happiness of their children. Ensuring that their children have the resources to help them pursue their dreams is often their top financial priority. Planning for the unexpected should include planning for illness. In the event that your child is diagnosed with a critical illness, you can receive... Read more »

Many Canadians are pleased to receive a tax refund each spring, but what if you had that money to spend each month when you really needed it and were able to contribute more to your RRSP contribution at the same time? Your employer is obligated to withhold income tax from your gross salary but you... Read more »

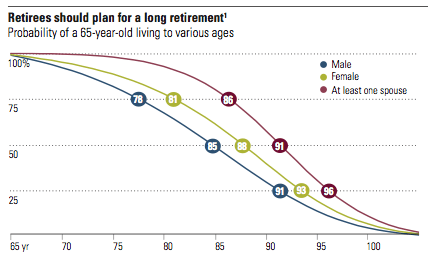

Longevity risk is the danger that you will outlive your money – and it is becoming a greater threat to a healthy retirement with every year that goes by. Why is longevity a threat? Because we are living longer than ever before. Since the turn of the last century, life expectancy beyond age 65 has... Read more »

Providing further benefit options to your employees can go a long way in showing them you value their efforts, and it can also attract skilled employees. A Group RRSP is a low-cost, highly effective way of supporting your employees’ efforts to increase retirement savings and wealth. As the employer, you pay no fees in establishing... Read more »

That’s an important question! How much money your family will need if you die and are not able to provide for them? Everyone’s financial picture and priorities are different but there are a few simple steps to determine a coverage amount that meets your needs. First, determine how much will your loved ones need to... Read more »